Explanation of Assisted Living Waiver Budget

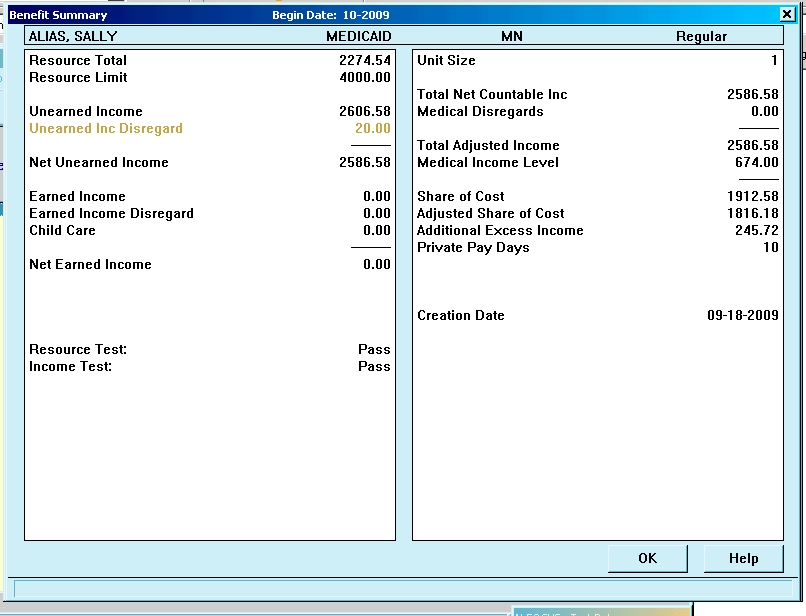

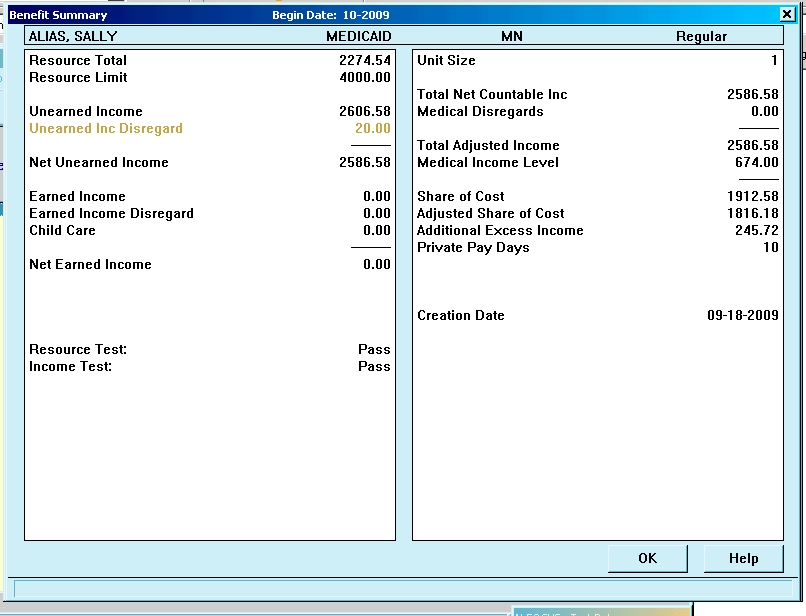

Gross income minus the Medicare premium, minus Board & Room (614) minus adjusted SOC=what client keeps-should be $80.00.

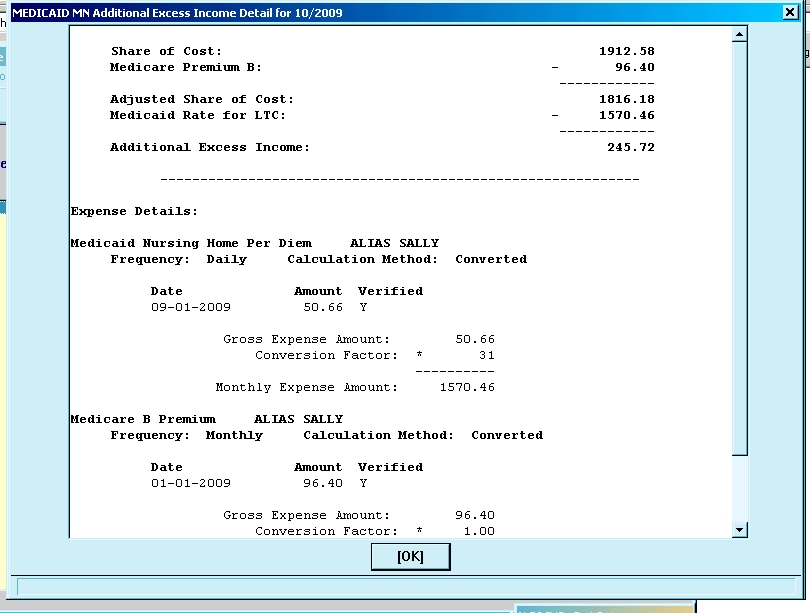

The Additional Excess Income is the difference between private pay ($77.25/ day) and Medicaid per diem ($50.66/day) which then tells us how many days a person's money is private pay.

The Additional Excess Income and the private pay days are bookkeeping pieces only for the facility. The facility will take the adjusted SOC amount and out of that figure, on paper, apply 10 days of that as private pay and the rest as Medicaid days.

In the notice, worker tells the family, if it isn't spelled out in the notice, to pay the Adjusted SOC plus the B&R. In this case, client pays $1816.18 plus $614.00.

(11-2009)