Adding_Tax_Household_Information

To create Tax Household information, follow these steps:

From the Detail Master Case window, select Actions > Tax Household.

The Detail Tax Household window will display. The Detail Tax Household window will open in Add mode to create a new Tax Household. If a Tax Household exists the List Tax Household window will display. On the List Tax Household window, select the New icon  to create a new Tax Household.

to create a new Tax Household.

Tax Households are based on the specific Tax Year.

More than one Tax Household may be created in a Master Case in a Tax Year but a person may only be in one Tax Household in a Tax Year. Every person, except an unborn, in a MAGI household must be configured in a Tax Household.

To add a new Tax Household, enter information in all of the appropriate fields.

- Tax Year - the specific year for which the Tax Household has been created. This is a mandatory field. The tax year will be indicated on the Application for Medicaid form.

- Medicaid Persons List Box - displays all of the people within the Master Case who are active or pending in Medicaid cases in the Master Case. Persons listed in this group box are not included in any other Tax Household for the specified year.

- Once a person is selected from this list box, the Person Detail icon and the Tax Filing Status options will become enabled.

- Tax Filing Status - this section contains Tax Filing Status options. Select/Highlight the person, then select the Tax Filing Status. Select the person's filing status based on responses on the application form.

- Add - Click the Add button to add the highlighted person to the Tax Household List Box.

- Clear - click the Clear button to clear the selection made.

- Tax Household - displays all of the persons listed in the Tax Household for the specified year and the selected Tax Filing Status.

- Number of people in the Tax Household other than those selected - enter the number of people who are not in the Master Case, but are claiming as a Tax Dependent as indicated on the application form.

Example: Every other year a father claims his child as a tax dependent even though the child lives in a different household with his mother. For the tax year that the father claims the child, enter the child as an Other Tax Household Member by entering 1 in this field.

Note: Information must be entered in this field in order for N-FOCUS to allow these dependents when budgeting. This field will be used to determine the size of the Tax Household

- Submit to INTERFACE - once the Tax Household information appears to be correct, click this button to save the Tax Household and submit a request for Tax Interface information from IRS via the HUB.

NOTE:

If the client did not indicate on the Application that we may request verification from the IRS do not click Submit to INTERFACE. Click Save, Save and Close or Save and Next. This will create the Tax Household for Medicaid budgeting purposes, but will not request the Interface. The Tax Household will then display on the List Window.

If the client did indicate on the Application that we may request verification from the IRS, click the Submit to INTERFACE button. This will submit the Tax Household for the interface and move the Tax Household to the Tax Household List window.

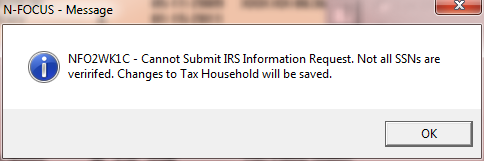

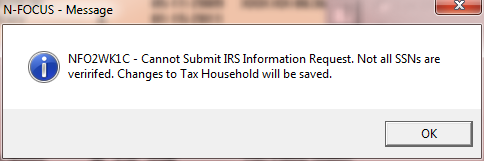

NOTE: If all the SSNs of Tax Household persons are not verified, the request will not be made to the IRS, however, the Tax Household will be saved. A message will open stating the SSNs are not verified. The Tax Household information will be saved when OK is clicked.

(09-2013)

![]() to create a new Tax Household.

to create a new Tax Household.